Writing an excellent dissertation proposal requires careful planning and meticulous attention to detail. Various aspects of dissertation proposal writing should be considered while drafting the paper. It can be complex for students especially if you are doing it for the first time in your life. If you need professional assignment experts who can write your dissertation or dissertation proposal on your behalf, you can contact us.

You should start your dissertation proposal assignment by clearly defining your research question or problem statement and by making sure it is evident with your field of study and focused on your subject. You need to conduct a thorough literature review and read through hundreds of papers to find the gaps in already existing research. You can also ask your professor/mentor for help with this. After which you need to work on a solid methodology that outlines your approach, data collection methods, and analysis techniques with appropriate tools to ensure that they are suitable for your research objectives. You also need to keep the formatting, referencing, and structure in mind while carefully giving importance to potential contributions to the field. Structure your proposal logically, with clear sections such as introduction, literature review, methodology, and anticipated outcomes to prepare an excellent research dissertation proposal.

For your help, in this article, we have given an example of how to create a perfect research dissertation proposal. It will help you understand the structure and pattern of writing and will act as a guiding tool in crafting your proposal.

Dissertation Proposal Example

Topic: Role of innovations in the contemporary fintech industry

Table of Contents

Chapter 1: Introduction and Research Background

Introduction

The contemporary finance market is evolving through the approaches of FinTech in the UK market by focusing on digital transformation on a large scale. According to Hodson, (2021), the extensive adoption of digital technologies in the financial service sector is creating a significant impact on the global market by attracting and retaining a large and diverse range of customers through innovative service approaches. However, innovation is playing a crucial role in the contemporary financial and banking business environment which is creating a significant competitive edge as well as sustainability for business organizations. However, this research significantly focuses on evaluating the contemporary and strategic approaches in the FinTech sector of the country emphasizing innovations related to service development on a large scale. The incorporation of primary research, focusing on qualitative and quantitative data analysis through interviews and surveys is the key approach of this research incorporation of a diverse range of subjective and objective data from the participants from different business organizations in the FinTech sector, has the potential to enhance the credibility and accuracy of the analytical approach in this primary research method.

Research problem

With the emergence of extensive digitalization in the financial and banking sector the incorporation of extensive innovation in service development is playing a vital role in the finance sector in this Industry 4.0 scenario. However, innovation is the key factor for creating sustainability and competitiveness for business organizations which is creating extensive levels of competition in the market (Obama, and Ezepue, 2018). UK-based companies like Revolt or Starling Bank is emphasizing investing a significant amount in developing customer-centric service development which creates rapid changes in the sector by focusing on customer-centric service developments. Apart from that, the current technological advancements show significant complexities in the areas of data security and compliance with government regulations which shows the impacts of traditional policy approaches from the government. On the other hand, Giglio, (2021), argues that issues like authorization and biometric authentication related to security issues and data encryption are also playing a crucial role in developing service approaches in the sector. Apart from that, the overall infrastructure in the country shows a lack of mobile and tech expertise which directly impacts the overall efficiency of service approaches of different FinTech companies. As technologies like big data and innovations in AI integration are still in the initial stage, the FinTech sector faces a significant amount of uncertainty and resistance from the customers which are creating adverse effects on the overall growth and sustainability of the company.

Aim and objectives

This study aims to critically evaluate the roles of innovations in the FinTech sector by investigating the scopes and challenges of digital transformation in the sector.

Objectives

- To evaluate the impacts of innovations through the digital transformation of financial services in the FinTech sector.

- To investigate the current challenges and scopes of digital transformation in the financial and banking sector in the UK market.

- To develop strategic approaches in the FinTech sector focusing on the incorporation of innovations for growth and sustainability.

Research questions

- What are the impacts of innovations through the digital transformation of financial services in the FinTech sector?

- What are the current challenges and scopes of digital transformation in the financial and banking sector in the UK market?

- What are the strategic approaches in the FinTech sector focusing on the incorporation of innovations for growth and sustainability?

Rationale

As Industry 4.0 is significantly impacting the financial and banking services in the contemporary business world. The effective evolution of the role of innovations in the FinTech sector is essential to develop in-depth knowledge and understanding. On the other hand, emphasizing the changes in consumer behavior is also an essential factor that needs to be addressed through critical analysis to enhance the role of innovations by creating a high degree of customer-centric services. The analytical approaches in the contemporary FinTech sector of the UK show the potential of an indication of current challenges and future scopes to enhance service efficiency as well as consumer experiences through incorporating digital transformation (Roper, and Turner, 2020). The development of integration and partnership through efficient communication channels as well as customer-centric service development is playing a vital role through innovations and adoption of advanced digital technologies in the current scenario.

Chapter 2: Literature Review

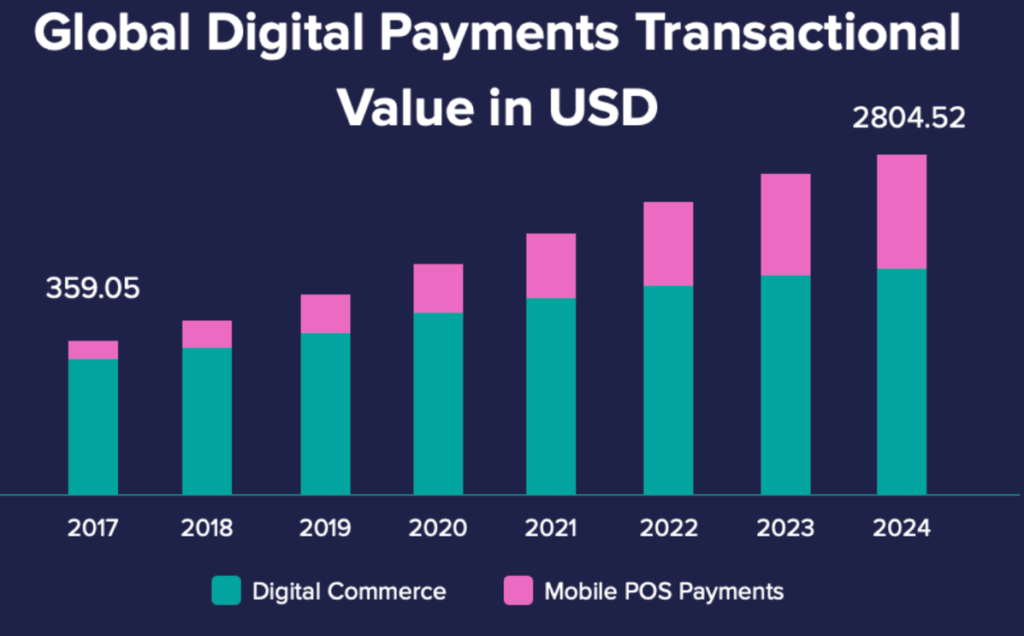

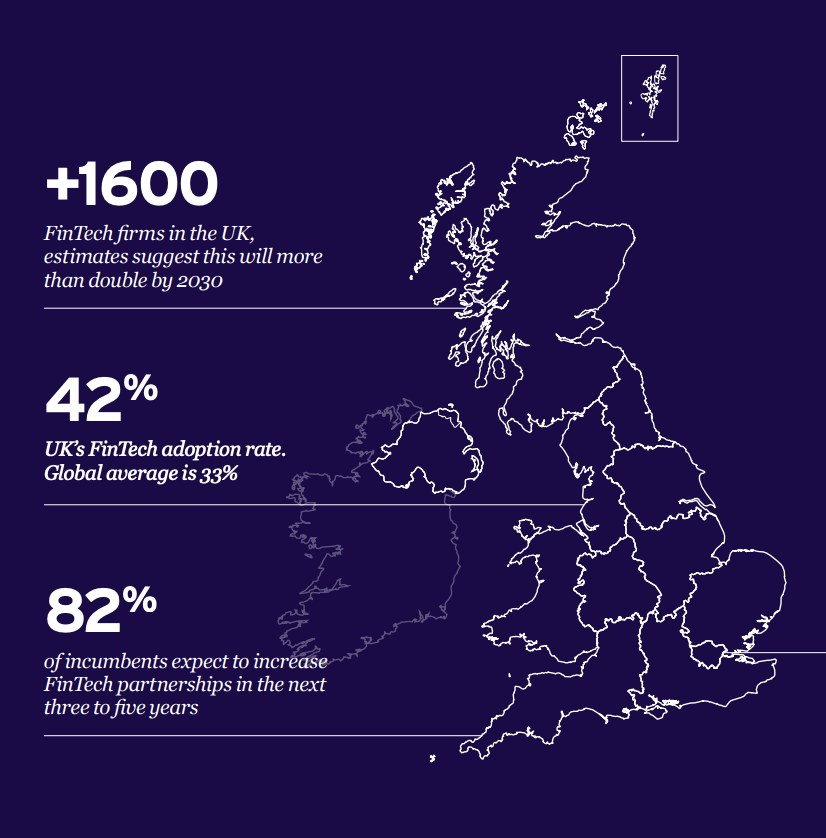

The current FinTech market in the UK is showing a valuation of $12.5 billion capital attraction with the Neobanking approach with a total transaction value of $761.30 billion (Moosa, 2022). However, extensive investment in technologies like cloud computing, artificial intelligence (AI), Internet of Things (IoT), and other blockchain technology incorporations is playing a vital role in evolving the FinTech sector. On the other hand, the UK is leading in the adoption of FinTech by 42% whereas the global average is showing 33% in the current global market context. In the current FinTech market, the worldwide growth projection shows 31.5 billion capital by the year 2026 which signifies four times more than it was six years ago (Suryono et al., 2020). The extensive focus on technologies like blockchain and IoT is creating an enormous amount of changes in FinTech services and business infrastructure.

The IoT-based innovations for oil to management platforms are playing a vital role in service development and customer satisfaction as well as integrating security approaches in the data management sector of fintech. However, the future of banking applications is significantly emphasizing the development of integration for payment solutions and automation by focusing on cloud computing. Mention, (2019), suggest that Innovative approaches like Software-as-a-Service (SaaS) and the most recent processes like Payments-as-a-Service (Paas) through extensive incorporation of cloud computing and open sources are creating enormous levels of technological adaptations for services like e-wallet, payouts, and remittances, virtual card issuing, or identity verification. On the other hand, innovative approaches to artificial intelligence (AI) in a diverse range of areas from financial innovation innovations to Robo advisors are influencing business processes and business models extensively (Golubev, and Ryabov, 2020). However, the scope of these technologies is significantly focusing on creating an integration with government and public services to enhance the reliability and authenticity of the banking services.

However, the current FinTech market scenario in the UK shows a significant complexity due to ineffective governmental policies as well as a lack of expertise in technology and mobile banking systems. These factors are currently creating significant issues in service development and service efficiency that can impact customer experiences significantly (Marin, and Vona, 2022). Apart from that, data security is a vital concern in the contemporary FinTech sector which shows the requirement for rapid improvement in virtual security by identifying the vulnerabilities in the financial service system. These factors need to be evaluated through extensive market data analysis. However, strategic modeling of the business organization’s business approaches in the FinTech sector needs to be focused on customer subjects or services as well as sustainability through robust technology and business infrastructure through continuous ICT skills development. Creating integration is one of the key factors in enhancing the sustainability and growth of FinTech companies through focusing on organizational cultures and HRM that can add value to the new business models of FinTech (Sibanda et al., 2020).

Chapter 3: Methodology

As this research focuses on the contemporary analysis of the FinTech sector and technological innovations. The incorporation of primary research is a significant factor for this study which signifies the implementation of quantitative and qualitative data analysis through the survey and interview of the employees from different FinTech companies in the UK. The incorporation of a diverse range of opinions and the strategically structured questionnaire of the survey and interview will incorporate authentic and reliable data related to the role of innovations in the FinTech sector of the country (El-Husseini et al., 2022). The data incorporation method of this research will focus on purposive sampling for selecting the participants to ensure a higher degree of efficiency in the overall research process. However, the philosophical approach of this research will focus on the incorporation of interpretivism research philosophy along with an inductive research approach, which has the potential to create a reasoning-based approach with manipulation of information bias of the primary data. However, ethical considerations are a crucial factor in the contemporary research processes, which ensures a higher degree of accountability and academic integrity of the research (Johnson et al., 2020). The researcher will focus on the fair treatment of the participants while respecting individualism and consent through official approaches of consent form verification. Developing academic integrity in the case of data management and storage will be a significant factor in this research, which can ensure a high degree of authenticity and credibility of the research process and outcome that can contribute to the future results related to the innovations and fintech sector.

References

Elhusseini, S.A., Tischner, C.M., Aspiranti, K.B. and Fedewa, A.L., 2022. A quantitative review of the effects of self-regulation interventions on primary and secondary student academic achievement. Metacognition and Learning, pp.1-23.

Giglio, F., 2021. Fintech: A literature review. European Research Studies Journal, 24(2B), pp.600-627.

Golubev, A. and Ryabov, O., 2020, November. Transformation of traditional financial companies into FinTech. In Proceedings of the International Scientific Conference-Digital Transformation on Manufacturing, Infrastructure, and Service (pp. 1-7).

Hodson, D., 2021. The politics of FinTech: Technology, regulation, and disruption in UK and German retail banking. Public Administration, 99(4), pp.859-872.

Johnson, J.L., Adkins, D. and Chauvin, S., 2020. A review of the quality indicators of rigor in qualitative research. American journal of pharmaceutical education, 84(1).

Marin, G. and Vona, F., 2022. Finance and the Reallocation of Scientific, Engineering and Mathematical Talent.

Mbama, C.I. and Ezepue, P.O., 2018. Digital banking, customer experience, and bank financial performance: UK customers’ perceptions. International Journal of Bank Marketing.

Mention, A.L., 2019. The future of fintech. Research-Technology Management, 62(4), pp.59-63.

Moosa, I., 2022. The evolution and revolution of fintech. In Fintech (pp. 18-32). Edward Elgar Publishing.

Roper, S. and Turner, J., 2020. R&D and innovation after COVID-19: What can we expect? A review of prior research and data trends after the great financial crisis. International Small Business Journal, 38(6), pp.504-514.

Sibanda, W., Ndiweni, E., Boulkeroua, M., Echchabi, A. and Ndlovu, T., 2020. Digital technology disruption on bank business models. International Journal of Business Performance Management, 21(1-2), pp.184-213.

Suryono, R.R., Budi, I. and Purwandari, B., 2020. Challenges and trends of financial technology (Fintech): a systematic literature review. Information, 11(12), p.590.

Need Thesis or Dissertation help online? Contact our customer care representative and order your assignment today!

Also Read Business Research Methods – Sample Research Proposal for MBA